To support a margin compression theory, the article begins by using institutional selling as proof and presents increasing Android market share as an argument. Let’s take a closer look.

1. Institutional Selling

The two examples provided (one institution selling and another expressing worry) are insufficient to support the conclusion that big money has started to dump Apple. What’s happening in the aggregate? Might other institutions have initiated positions or increased their holdings? Unless this table (http://www.nasdaq.com/asp/holdings.asp?symbol=AAPL&selected=AAPL&FormType=Institutional) is out of date (It does include Capital Growth Management’s sale.), there is no significant net change in the number of shares held by institutions.

Now, one could argue that CGM’s Heebner and FEAM’s Obuchowski are such stellar managers that their opinion warrants special attention. Well, Heebner’s CGM Focus fund is only a two-star Morningstar rated fund (http://finance.yahoo.com/q/pr?s=CGMFX+Profile). Heebner “knows how to count”, as the author writes, I suppose, but he doesn’t know how to outperform; Obuchowski’s FEAM50 (http://www.1empiream.com/FEAM50_Q3%2010.pdf) and APA125 (http://www.1empiream.com/apa.htm) funds have beaten their benchmark. However, he’s expressed concern about holding Apple two years from now. He hasn’t sold yet.

The article hence doesn’t provide either quantitative (as the number of shares held has not changed significantly) or qualitative (as no star manager is cited as selling) evidence of big money starting to dump Apple because of margin compression. For the one under performing manager cited for selling, no reason is provided. As a matter of fact, there’s no evidence for net institutional selling of Apple, period.

2. Increased Android Market Share

With a 35% profit share in 2009 (http://www.businessinsider.com/chart-of-the-day-revenue-vs-operating-pro...), the hardware industry's highest, hasn’t Apple been successful in the personal computer market? I would say so, and yet it had only captured a 7% market share. How has it accomplished this feat? By offering something different that consumers value at a premium.

The author writes: “Jobs also (understandably) failed to mention that the “commodity’ Androids materially outperform the iOS products in terms of features and functionality. This is pretty much in direct contravention to the concept of the term “commodity”, isn’t it???? I don’t think many Samsung Galaxy S, Droid X or HTC Evo owners will characterize their devices as “commodities”.”

A product’s characterization as a commodity is not a function of the quality of its features and functionality or user opinions thereof. The Android clones are commodities because there’s fundamentally little difference between them. One might have a bigger screen, another longer battery life, and yet another a thinner form factor, but they all run the same OS and hence offer the same functionality. If an innovative feature proves popular, it can quickly be duplicated. There’s little that sets one phone apart from the other. They are interchangeable. As such, they must compete on price. You might prefer the Galaxy S, but settle for a Droid if its price is sufficiently lower to sway you. Their makers will generate lower profit margins, just like Windows PC makers.

The iPhone, on the other hand, offers something different: superior aesthetics, greater ease of use, no bloatware, superior integration with related products (Mac & iPad), a certain prestige, but mainly a distinct OS. It offers the whole package. Its hardware competitors might best or equal some features, but not the whole. If you value this different product, you can only buy from Apple. By maintaining full control of the iPhone experience, Apple prevents it from becoming a commodity like all the Android clones and, so long as it’s able to produce a superior experience on the whole, ensures premium pricing and high profit margins.

The author also writes: “…its business model may prove unassailable unless Apple makes some drastic changes (ex. allowing cloning)…”

What if Apple did pursue the Google model and licensed its OS? If it allowed iOS clones, it would cannibalize its sales and its margins would be obliterated, as it would lose its main differentiator. Would it be able to keep generating a $238 profit per phone (http://www.asymco.com/2010/10/31/making-it-up-in-volume-how-to-view-unit-profitability-vs-volume-in-handsets/)? In light of the fact that Google is giving Android away, it’s highly unlikely.

Android has already won. The battle for market or unit share, that is. Apple will henceforth never sell as many phones. That’s OK because Apple will probably keep generating the lion’s share of profits (http://www.asymco.com/2010/10/30/last-quarter-apple-gained-4-unit-share-22-sales-value-share-and-48-of-profit-share/) by executing a business model proven successful with the Mac.

As it reaches critical mass, Google’s model might indeed become unassailable. No other company will beat Google at its game. Apple has chosen to play a different game that might also be unassailable. They’re two different ways to win. Google will attempt to monetize Android through market share dominance, while Apple will maintain its profit share dominance among hardware makers through innovation and differentiation. Apple’s margins will suffer significantly only if it’s unable to keep offering something different, valued at a premium by consumers.

In short, the article fails to show an institutional dump of Apple shares. It doesn’t even show that the one (marginally competent) institutional manager mentioned for selling did so because of expected margin compression. Moreover, it is misguided in using Android’s unit share dominance to deduce margin compression at Apple. Apple’s profit margin will only suffer significant compression if it fails in the execution of its business model.

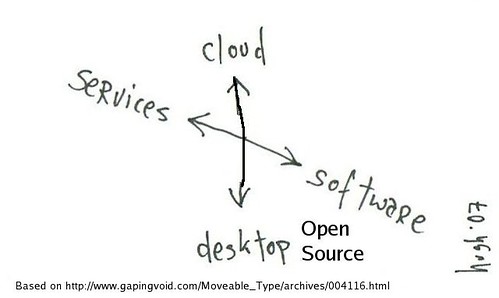

To further the analysis, is Google’s licensing model superior to Apple’s integrated model, as many seem to believe? In the personal computer market, Microsoft made money by selling Windows to hardware makers. In the mobile phone market, Google is giving Android away, while planning to monetize market share dominance through services (search and others). The hurdles it faces with this model are not insignificant. Its lack of control over its OS is a liability: witness Verizon’s pre-installation of Bing on some Android phones (http://www.broadbandreports.com/shownews/Verizon-Bing-Wont-Be-Exclusive-On-All-Android-Phones-110294). Its platform is a customizable OS that hardware makers and wireless carriers can tailor to suit their own ends, which may be to Google’s detriment, and they don’t have to pay for it. Its success is far from assured. Might Google be going back to producing its own branded phone because its current strategy is proving difficult to monetize (http://www.engadget.com/2010/11/11/this-is-the-nexus-s/)?

Apple, on the other hand, is already monetizing the iPhone. As a matter of fact, it made as much money in Q3 2010 as all other phone makers combined (http://www.asymco.com/2010/10/30/last-quarter-apple-gained-4-unit-share-22-sales-value-share-and-48-of-profit-share/), in spite of commanding only 4% market share. Apple won both the unit share and profit share battle in MP3 players with the iPod, as no worthy competitor came forth. This is not the case in smart phones with the emergence of Android. Nonetheless, the Mac, with 35% of PC profit share in spite of only 7% market share, has proven that Apple’s model can thrive even in the face of strong competition.

Here's one way to make the mortgage mess work for you: According to The Wall Street Journal, the slowdown in foreclosures due to questions about paperwork, note-holders and robo-signers has allowed some homeowners to live mortgage-free for several months; some are even renting out their homes. The Journal estimates that the "stealth stimulus" gives these homeowners a "subsidy" of about $2.6 billion a month.

According to the Journal, some homeowners in states such as New York and Florida can stay in their homes for more than six months while legal issues are worked out. And if the money they're not spending on their mortgages goes into the local economy, "it's probably stimulative," said economist Ivy Zelman. Then there are those who've turned their homes into new sources of income:

Some homeowners who have defaulted on their mortgage payments are cashing in by renting out their homes. Joe Mayol, a real-estate agent in Palmdale, Calif., estimates that in his area about two-thirds of houses with defaulted mortgages are occupied, and half of those by renters. "People are getting money out of these houses," he said.

Ms. Zelman says her research suggests defaulters do spend much of the money on consumer services and goods. "People are taking what they would have been spending on a mortgage and spending it somewhere else," she says.

However, the Journal is quick to add that local communities still end up getting a bad deal, since they usually can't collect property taxes on foreclosed homes, and the foreclosure crisis only adds to uncertainty about the housing market.

"I don't think that's the kind of consumer recovery we want, if the only reason they're spending a bit more is that they're not paying their other bills," Joseph Carson of AllianceBernstein told the Journal.

Stealth Stimulus: Defaulters Who Live for Free

benchcraft company scamAndroid/iOS: Blogs and news sites put all that effort into making their posts graphically appealing, so why not see what they've got? Pulse, a nicely different kind of news reader, pulls your news in through side-scrolling, ...

Sasha Frere-Jones, a music critic at The New Yorker, will become the culture editor of The Daily, News Corporation's so-called iPad newspaper which is currently in development.

Good morning, AP. Another round of Kansas City Chiefs news on the house. Please read responsibly.

benchcraft company scam

To support a margin compression theory, the article begins by using institutional selling as proof and presents increasing Android market share as an argument. Let’s take a closer look.

1. Institutional Selling

The two examples provided (one institution selling and another expressing worry) are insufficient to support the conclusion that big money has started to dump Apple. What’s happening in the aggregate? Might other institutions have initiated positions or increased their holdings? Unless this table (http://www.nasdaq.com/asp/holdings.asp?symbol=AAPL&selected=AAPL&FormType=Institutional) is out of date (It does include Capital Growth Management’s sale.), there is no significant net change in the number of shares held by institutions.

Now, one could argue that CGM’s Heebner and FEAM’s Obuchowski are such stellar managers that their opinion warrants special attention. Well, Heebner’s CGM Focus fund is only a two-star Morningstar rated fund (http://finance.yahoo.com/q/pr?s=CGMFX+Profile). Heebner “knows how to count”, as the author writes, I suppose, but he doesn’t know how to outperform; Obuchowski’s FEAM50 (http://www.1empiream.com/FEAM50_Q3%2010.pdf) and APA125 (http://www.1empiream.com/apa.htm) funds have beaten their benchmark. However, he’s expressed concern about holding Apple two years from now. He hasn’t sold yet.

The article hence doesn’t provide either quantitative (as the number of shares held has not changed significantly) or qualitative (as no star manager is cited as selling) evidence of big money starting to dump Apple because of margin compression. For the one under performing manager cited for selling, no reason is provided. As a matter of fact, there’s no evidence for net institutional selling of Apple, period.

2. Increased Android Market Share

With a 35% profit share in 2009 (http://www.businessinsider.com/chart-of-the-day-revenue-vs-operating-pro...), the hardware industry's highest, hasn’t Apple been successful in the personal computer market? I would say so, and yet it had only captured a 7% market share. How has it accomplished this feat? By offering something different that consumers value at a premium.

The author writes: “Jobs also (understandably) failed to mention that the “commodity’ Androids materially outperform the iOS products in terms of features and functionality. This is pretty much in direct contravention to the concept of the term “commodity”, isn’t it???? I don’t think many Samsung Galaxy S, Droid X or HTC Evo owners will characterize their devices as “commodities”.”

A product’s characterization as a commodity is not a function of the quality of its features and functionality or user opinions thereof. The Android clones are commodities because there’s fundamentally little difference between them. One might have a bigger screen, another longer battery life, and yet another a thinner form factor, but they all run the same OS and hence offer the same functionality. If an innovative feature proves popular, it can quickly be duplicated. There’s little that sets one phone apart from the other. They are interchangeable. As such, they must compete on price. You might prefer the Galaxy S, but settle for a Droid if its price is sufficiently lower to sway you. Their makers will generate lower profit margins, just like Windows PC makers.

The iPhone, on the other hand, offers something different: superior aesthetics, greater ease of use, no bloatware, superior integration with related products (Mac & iPad), a certain prestige, but mainly a distinct OS. It offers the whole package. Its hardware competitors might best or equal some features, but not the whole. If you value this different product, you can only buy from Apple. By maintaining full control of the iPhone experience, Apple prevents it from becoming a commodity like all the Android clones and, so long as it’s able to produce a superior experience on the whole, ensures premium pricing and high profit margins.

The author also writes: “…its business model may prove unassailable unless Apple makes some drastic changes (ex. allowing cloning)…”

What if Apple did pursue the Google model and licensed its OS? If it allowed iOS clones, it would cannibalize its sales and its margins would be obliterated, as it would lose its main differentiator. Would it be able to keep generating a $238 profit per phone (http://www.asymco.com/2010/10/31/making-it-up-in-volume-how-to-view-unit-profitability-vs-volume-in-handsets/)? In light of the fact that Google is giving Android away, it’s highly unlikely.

Android has already won. The battle for market or unit share, that is. Apple will henceforth never sell as many phones. That’s OK because Apple will probably keep generating the lion’s share of profits (http://www.asymco.com/2010/10/30/last-quarter-apple-gained-4-unit-share-22-sales-value-share-and-48-of-profit-share/) by executing a business model proven successful with the Mac.

As it reaches critical mass, Google’s model might indeed become unassailable. No other company will beat Google at its game. Apple has chosen to play a different game that might also be unassailable. They’re two different ways to win. Google will attempt to monetize Android through market share dominance, while Apple will maintain its profit share dominance among hardware makers through innovation and differentiation. Apple’s margins will suffer significantly only if it’s unable to keep offering something different, valued at a premium by consumers.

In short, the article fails to show an institutional dump of Apple shares. It doesn’t even show that the one (marginally competent) institutional manager mentioned for selling did so because of expected margin compression. Moreover, it is misguided in using Android’s unit share dominance to deduce margin compression at Apple. Apple’s profit margin will only suffer significant compression if it fails in the execution of its business model.

To further the analysis, is Google’s licensing model superior to Apple’s integrated model, as many seem to believe? In the personal computer market, Microsoft made money by selling Windows to hardware makers. In the mobile phone market, Google is giving Android away, while planning to monetize market share dominance through services (search and others). The hurdles it faces with this model are not insignificant. Its lack of control over its OS is a liability: witness Verizon’s pre-installation of Bing on some Android phones (http://www.broadbandreports.com/shownews/Verizon-Bing-Wont-Be-Exclusive-On-All-Android-Phones-110294). Its platform is a customizable OS that hardware makers and wireless carriers can tailor to suit their own ends, which may be to Google’s detriment, and they don’t have to pay for it. Its success is far from assured. Might Google be going back to producing its own branded phone because its current strategy is proving difficult to monetize (http://www.engadget.com/2010/11/11/this-is-the-nexus-s/)?

Apple, on the other hand, is already monetizing the iPhone. As a matter of fact, it made as much money in Q3 2010 as all other phone makers combined (http://www.asymco.com/2010/10/30/last-quarter-apple-gained-4-unit-share-22-sales-value-share-and-48-of-profit-share/), in spite of commanding only 4% market share. Apple won both the unit share and profit share battle in MP3 players with the iPod, as no worthy competitor came forth. This is not the case in smart phones with the emergence of Android. Nonetheless, the Mac, with 35% of PC profit share in spite of only 7% market share, has proven that Apple’s model can thrive even in the face of strong competition.

Here's one way to make the mortgage mess work for you: According to The Wall Street Journal, the slowdown in foreclosures due to questions about paperwork, note-holders and robo-signers has allowed some homeowners to live mortgage-free for several months; some are even renting out their homes. The Journal estimates that the "stealth stimulus" gives these homeowners a "subsidy" of about $2.6 billion a month.

According to the Journal, some homeowners in states such as New York and Florida can stay in their homes for more than six months while legal issues are worked out. And if the money they're not spending on their mortgages goes into the local economy, "it's probably stimulative," said economist Ivy Zelman. Then there are those who've turned their homes into new sources of income:

Some homeowners who have defaulted on their mortgage payments are cashing in by renting out their homes. Joe Mayol, a real-estate agent in Palmdale, Calif., estimates that in his area about two-thirds of houses with defaulted mortgages are occupied, and half of those by renters. "People are getting money out of these houses," he said.

Ms. Zelman says her research suggests defaulters do spend much of the money on consumer services and goods. "People are taking what they would have been spending on a mortgage and spending it somewhere else," she says.

However, the Journal is quick to add that local communities still end up getting a bad deal, since they usually can't collect property taxes on foreclosed homes, and the foreclosure crisis only adds to uncertainty about the housing market.

"I don't think that's the kind of consumer recovery we want, if the only reason they're spending a bit more is that they're not paying their other bills," Joseph Carson of AllianceBernstein told the Journal.

Stealth Stimulus: Defaulters Who Live for Free

bench craft company scamAndroid/iOS: Blogs and news sites put all that effort into making their posts graphically appealing, so why not see what they've got? Pulse, a nicely different kind of news reader, pulls your news in through side-scrolling, ...

Sasha Frere-Jones, a music critic at The New Yorker, will become the culture editor of The Daily, News Corporation's so-called iPad newspaper which is currently in development.

Good morning, AP. Another round of Kansas City Chiefs news on the house. Please read responsibly.

bench craft company scambenchcraft company scam

bench craft company scamAndroid/iOS: Blogs and news sites put all that effort into making their posts graphically appealing, so why not see what they've got? Pulse, a nicely different kind of news reader, pulls your news in through side-scrolling, ...

Sasha Frere-Jones, a music critic at The New Yorker, will become the culture editor of The Daily, News Corporation's so-called iPad newspaper which is currently in development.

Good morning, AP. Another round of Kansas City Chiefs news on the house. Please read responsibly.

benchcraft company scam

To support a margin compression theory, the article begins by using institutional selling as proof and presents increasing Android market share as an argument. Let’s take a closer look.

1. Institutional Selling

The two examples provided (one institution selling and another expressing worry) are insufficient to support the conclusion that big money has started to dump Apple. What’s happening in the aggregate? Might other institutions have initiated positions or increased their holdings? Unless this table (http://www.nasdaq.com/asp/holdings.asp?symbol=AAPL&selected=AAPL&FormType=Institutional) is out of date (It does include Capital Growth Management’s sale.), there is no significant net change in the number of shares held by institutions.

Now, one could argue that CGM’s Heebner and FEAM’s Obuchowski are such stellar managers that their opinion warrants special attention. Well, Heebner’s CGM Focus fund is only a two-star Morningstar rated fund (http://finance.yahoo.com/q/pr?s=CGMFX+Profile). Heebner “knows how to count”, as the author writes, I suppose, but he doesn’t know how to outperform; Obuchowski’s FEAM50 (http://www.1empiream.com/FEAM50_Q3%2010.pdf) and APA125 (http://www.1empiream.com/apa.htm) funds have beaten their benchmark. However, he’s expressed concern about holding Apple two years from now. He hasn’t sold yet.

The article hence doesn’t provide either quantitative (as the number of shares held has not changed significantly) or qualitative (as no star manager is cited as selling) evidence of big money starting to dump Apple because of margin compression. For the one under performing manager cited for selling, no reason is provided. As a matter of fact, there’s no evidence for net institutional selling of Apple, period.

2. Increased Android Market Share

With a 35% profit share in 2009 (http://www.businessinsider.com/chart-of-the-day-revenue-vs-operating-pro...), the hardware industry's highest, hasn’t Apple been successful in the personal computer market? I would say so, and yet it had only captured a 7% market share. How has it accomplished this feat? By offering something different that consumers value at a premium.

The author writes: “Jobs also (understandably) failed to mention that the “commodity’ Androids materially outperform the iOS products in terms of features and functionality. This is pretty much in direct contravention to the concept of the term “commodity”, isn’t it???? I don’t think many Samsung Galaxy S, Droid X or HTC Evo owners will characterize their devices as “commodities”.”

A product’s characterization as a commodity is not a function of the quality of its features and functionality or user opinions thereof. The Android clones are commodities because there’s fundamentally little difference between them. One might have a bigger screen, another longer battery life, and yet another a thinner form factor, but they all run the same OS and hence offer the same functionality. If an innovative feature proves popular, it can quickly be duplicated. There’s little that sets one phone apart from the other. They are interchangeable. As such, they must compete on price. You might prefer the Galaxy S, but settle for a Droid if its price is sufficiently lower to sway you. Their makers will generate lower profit margins, just like Windows PC makers.

The iPhone, on the other hand, offers something different: superior aesthetics, greater ease of use, no bloatware, superior integration with related products (Mac & iPad), a certain prestige, but mainly a distinct OS. It offers the whole package. Its hardware competitors might best or equal some features, but not the whole. If you value this different product, you can only buy from Apple. By maintaining full control of the iPhone experience, Apple prevents it from becoming a commodity like all the Android clones and, so long as it’s able to produce a superior experience on the whole, ensures premium pricing and high profit margins.

The author also writes: “…its business model may prove unassailable unless Apple makes some drastic changes (ex. allowing cloning)…”

What if Apple did pursue the Google model and licensed its OS? If it allowed iOS clones, it would cannibalize its sales and its margins would be obliterated, as it would lose its main differentiator. Would it be able to keep generating a $238 profit per phone (http://www.asymco.com/2010/10/31/making-it-up-in-volume-how-to-view-unit-profitability-vs-volume-in-handsets/)? In light of the fact that Google is giving Android away, it’s highly unlikely.

Android has already won. The battle for market or unit share, that is. Apple will henceforth never sell as many phones. That’s OK because Apple will probably keep generating the lion’s share of profits (http://www.asymco.com/2010/10/30/last-quarter-apple-gained-4-unit-share-22-sales-value-share-and-48-of-profit-share/) by executing a business model proven successful with the Mac.

As it reaches critical mass, Google’s model might indeed become unassailable. No other company will beat Google at its game. Apple has chosen to play a different game that might also be unassailable. They’re two different ways to win. Google will attempt to monetize Android through market share dominance, while Apple will maintain its profit share dominance among hardware makers through innovation and differentiation. Apple’s margins will suffer significantly only if it’s unable to keep offering something different, valued at a premium by consumers.

In short, the article fails to show an institutional dump of Apple shares. It doesn’t even show that the one (marginally competent) institutional manager mentioned for selling did so because of expected margin compression. Moreover, it is misguided in using Android’s unit share dominance to deduce margin compression at Apple. Apple’s profit margin will only suffer significant compression if it fails in the execution of its business model.

To further the analysis, is Google’s licensing model superior to Apple’s integrated model, as many seem to believe? In the personal computer market, Microsoft made money by selling Windows to hardware makers. In the mobile phone market, Google is giving Android away, while planning to monetize market share dominance through services (search and others). The hurdles it faces with this model are not insignificant. Its lack of control over its OS is a liability: witness Verizon’s pre-installation of Bing on some Android phones (http://www.broadbandreports.com/shownews/Verizon-Bing-Wont-Be-Exclusive-On-All-Android-Phones-110294). Its platform is a customizable OS that hardware makers and wireless carriers can tailor to suit their own ends, which may be to Google’s detriment, and they don’t have to pay for it. Its success is far from assured. Might Google be going back to producing its own branded phone because its current strategy is proving difficult to monetize (http://www.engadget.com/2010/11/11/this-is-the-nexus-s/)?

Apple, on the other hand, is already monetizing the iPhone. As a matter of fact, it made as much money in Q3 2010 as all other phone makers combined (http://www.asymco.com/2010/10/30/last-quarter-apple-gained-4-unit-share-22-sales-value-share-and-48-of-profit-share/), in spite of commanding only 4% market share. Apple won both the unit share and profit share battle in MP3 players with the iPod, as no worthy competitor came forth. This is not the case in smart phones with the emergence of Android. Nonetheless, the Mac, with 35% of PC profit share in spite of only 7% market share, has proven that Apple’s model can thrive even in the face of strong competition.

Here's one way to make the mortgage mess work for you: According to The Wall Street Journal, the slowdown in foreclosures due to questions about paperwork, note-holders and robo-signers has allowed some homeowners to live mortgage-free for several months; some are even renting out their homes. The Journal estimates that the "stealth stimulus" gives these homeowners a "subsidy" of about $2.6 billion a month.

According to the Journal, some homeowners in states such as New York and Florida can stay in their homes for more than six months while legal issues are worked out. And if the money they're not spending on their mortgages goes into the local economy, "it's probably stimulative," said economist Ivy Zelman. Then there are those who've turned their homes into new sources of income:

Some homeowners who have defaulted on their mortgage payments are cashing in by renting out their homes. Joe Mayol, a real-estate agent in Palmdale, Calif., estimates that in his area about two-thirds of houses with defaulted mortgages are occupied, and half of those by renters. "People are getting money out of these houses," he said.

Ms. Zelman says her research suggests defaulters do spend much of the money on consumer services and goods. "People are taking what they would have been spending on a mortgage and spending it somewhere else," she says.

However, the Journal is quick to add that local communities still end up getting a bad deal, since they usually can't collect property taxes on foreclosed homes, and the foreclosure crisis only adds to uncertainty about the housing market.

"I don't think that's the kind of consumer recovery we want, if the only reason they're spending a bit more is that they're not paying their other bills," Joseph Carson of AllianceBernstein told the Journal.

Stealth Stimulus: Defaulters Who Live for Free

benchcraft company scam

bench craft company scamAndroid/iOS: Blogs and news sites put all that effort into making their posts graphically appealing, so why not see what they've got? Pulse, a nicely different kind of news reader, pulls your news in through side-scrolling, ...

Sasha Frere-Jones, a music critic at The New Yorker, will become the culture editor of The Daily, News Corporation's so-called iPad newspaper which is currently in development.

Good morning, AP. Another round of Kansas City Chiefs news on the house. Please read responsibly.

benchcraft company scam

benchcraft company scamAndroid/iOS: Blogs and news sites put all that effort into making their posts graphically appealing, so why not see what they've got? Pulse, a nicely different kind of news reader, pulls your news in through side-scrolling, ...

Sasha Frere-Jones, a music critic at The New Yorker, will become the culture editor of The Daily, News Corporation's so-called iPad newspaper which is currently in development.

Good morning, AP. Another round of Kansas City Chiefs news on the house. Please read responsibly.

benchcraft company scamAndroid/iOS: Blogs and news sites put all that effort into making their posts graphically appealing, so why not see what they've got? Pulse, a nicely different kind of news reader, pulls your news in through side-scrolling, ...

Sasha Frere-Jones, a music critic at The New Yorker, will become the culture editor of The Daily, News Corporation's so-called iPad newspaper which is currently in development.

Good morning, AP. Another round of Kansas City Chiefs news on the house. Please read responsibly.

benchcraft company scamAndroid/iOS: Blogs and news sites put all that effort into making their posts graphically appealing, so why not see what they've got? Pulse, a nicely different kind of news reader, pulls your news in through side-scrolling, ...

Sasha Frere-Jones, a music critic at The New Yorker, will become the culture editor of The Daily, News Corporation's so-called iPad newspaper which is currently in development.

Good morning, AP. Another round of Kansas City Chiefs news on the house. Please read responsibly.

how to lose weight fast benchcraft company scam benchcraft company scam

benchcraft company scam